Auto Insurance Requirements

Auto insurance requirements may vary some from state to state. But paying attention to auto insurance terminology may be critical when it comes to finding auto insurance. Some of the auto insurance terms you may hear bandied about are useful to know when it comes to finding car insurance that could work well for you.

Get quotes for top rated car insurance!

According to the Insurance Information Institute, drivers should consider carrying minimum auto insurance requirements of $100,000 bodily injury protection coverage, with $300,000 coverage per accident (which would be 100/300 in auto insurance terminology.)

Auto insurance requirements are sometimes represented with auto insurance terms that are a set of three numbers, like 20/40/10. Those three numbers are part of auto insurance terminology.

The number 20, or whatever the number is, is for the maximum liability protection for bodily injury for one person hurt in a car accident – 20 equals $20,000, or it could be 25 for $25,000 or some other number, depending on which state you live in.

In this case, the number 40 would stand in for the maximum liability protection for bodily injury for all people hurt in a car accident. The number 40 equals $40,000 in this scenario. This number may be different, depending on which state you live in.

The final number, 10, could represent the maximum liability protection for property damage in an auto accident (the number 10 equals $10,000 in this scenario. The auto insurance requirements for this coverage could differ by state.)

Carrying the minimum auto insurance requirements may help to protect your liability in the case of an auto accident. That is the case even if you are driving in a different state with a higher minimum liability requirement. Now, if you were to move to a different state, with higher minimums on liability insurance, those auto insurance requirements would change on your auto insurance premiums.

Some states have “no fault” auto insurance laws. The way it works is that whatever company you have car insurance with could be possibly required by law to pay out a claim for bodily injury, no matter who is at fault in a car accident. However, in those states, people can sue parties involved after the accident.

Here’s the thing – you may want to have adequate protection after a car accident, so that you have enough coverage to protect you. In some cases, depending on which state you live in, you could want more than the minimum coverage, so that you may be protected. Here’s where this could help you. For example, if you only had a $10,000 maximum property damage liability, and you got into a collision with a Porsche, you could be paying through the nose if you are judged to be at fault. So you might want to consider getting more than the minimum auto insurance requirements, for that reason.

The phrase “auto insurance terms” might not just refer to the words used, or the terminology, but the terms of an auto insurance policy. To find out more about what coverage you could be eligible, just fill out this quote form, and you could find a car insurance policy that could be right for you.

Related Articles

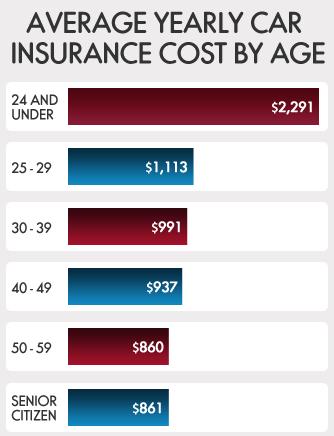

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.