Low Cost Auto Insurance: Frequently Asked Questions

Looking for low cost auto insurance from top auto insurance companies? You may have some questions about what all that entails, as well as whether getting good property damage liability and body injury liability coverage may affect the rates. You can get started today by getting information on auto insurance rates that could be right for you.

Get quotes for some of the top rated car insurance!

Here are some of the most frequently asked questions related to low cost auto insurance:

How are car insurance rates determined?

There are a variety of factors that may be taken into account with insurance rates, such as your driving record, how much you drive, what kind of car you drive, where you drive and where you live. What type of car you drive also comes into play – if you are were to buy a Maybach or a Bentley, you could be in for a real sticker shock when you receive your first auto insurance bill. Due to the fact that both cars are worth literally hundreds of thousands of dollars each, the auto insurance rates may be significantly higher than if you were to buy, say, a Toyota or even a Lexus, due to the repair costs from an accident, as well as comprehensive coverage to protect against theft, fire, and other damages.

What about the car insurance coverage? Do some of the top auto insurance companies offer higher coverage limits than others?

Yes, that could be true, depending on the state, and the situation. If purchasing the highest limit liability coverage is important to you, because you want to make sure you are covered against any such claims, you might want to ask any insurance companies you could be interested in what their limits are.

How does a deductible work with getting low cost car insurance rates?

A deductible is the out-of-pocket amount you would be required to pay before the rest of the insurance kicked in. Generally speaking, the higher the deductible, the lower your monthly auto insurance premium might be. For example, if you were to be held responsible for a one-car accident, you suffered $2000 in damage to your car, and had collision coverage with a $250 deductible, you would receive $1750 to repair the car. If you had a $500 deductible; you would get $1500 back. If you had a $1000 deductible, you would only get back $1000. However, your monthly insurance premium with a high deductible would generally be significantly lower than if you had either no deductible, or a smaller one.

Now, if you were to have a bunch of savings in an emergency fund, you could have a higher deductible, with a lower monthly insurance premium, and then potentially use some of that savings to protect yourself if you needed to, in the case of a collision or a comprehensive claim, to name two examples.

What if I already have some of the auto insurance protection from another provider?

If you have roadside assistance coverage from AAA, or towing coverage elsewhere, you don’t want to purchase the same thing twice. So please read the fine print with any auto insurance coverage offers you may receive before signing up for anything.

Where can I get a quote?

You may get information from what could be the top auto insurance companies by simply filling out this quote form and answering a few questions. Get started now!

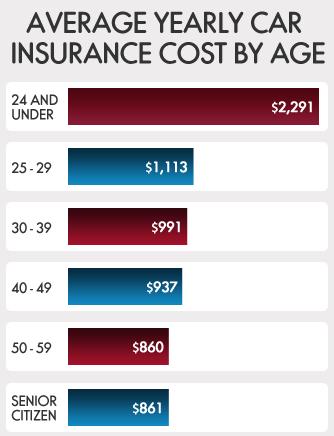

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.