Liability Car Insurance

Liability car insurance is a requirement when it comes to operating an automobile. However, that doesn’t mean that you have to stay with the same liability auto insurance you have always used. Nowadays, you can shop for auto liability insurance online without having to go through a whole rigaramole of looking for auto insurance by going around town finding quotes for liability car insurance in person.

Get quotes for liability car insurance!

So what, exactly, is liability car insurance? Liability insurance is mandatory for a car being driven in every state. There are two main things that can be protected in auto liability insurance – bodily injury coverage, and property damage coverage. The way this works is that liability coverage can protect you in case you and your car cause damage to property, or to another person. For example, if you got into an auto accident where you were judged to be at fault, and you caused damage to the other person’s car, and the other person hurt his neck in the accident, having liability car insurance may help protect you here. Instead of having to pay for the damages out of your own pocket, liability insurance could pay for the damages you could owe.

Liability insurance is required because this way, people wouldn’t have to sue for damages any time they got hurt in a car accident. Without liability car insurance , there could be chaos on the roads, with cars damaged, and people hurt, without an easy way to get compensated for such damage.

The way minimums are described when it comes to liability auto insurance is usually written in three numbers – such as 25/50/15. There are three different components in this set of numbers, and the numbers itself represent numbers of thousands:

The first number represents the required coverage needed for bodily injury liability coverage for one person hurt in a car accident. The second number is the bodily injury liability for all of the people hurt in the accident. The third number is the property damage coverage for the accident. These are meant to cover property damage and physical damage in the case of a car collision.

Now, in some cases, like if you were to collide with a Porsche, these numbers might not be enough to cover your financial responsibility. Therefore, you might want to raise your amounts covered for liability insurance. In some cases, you may be able to find you a very reasonable rate on additional liability coverage, depending on the situation. You might want to spend a few minutes figuring out how much liability auto insurance you might need, depending on your individual situation and worst-case scenarios. Some insurance agents say you should get as much liability insurance coverage as you can afford.

To get rate information about liability auto insurance, simply answer a few questions about yourself, your automobile, and your driving record by answering this quote form’s questions, and you could find liability rates that could work well for you.

Related Article:

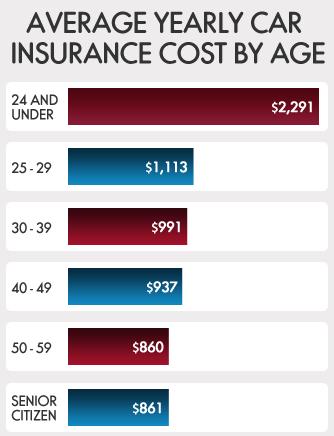

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.