Low Cost Auto Insurance

Looking for potentially low cost auto insurance? You may find that you could discover what could be the lowest auto insurance to fit your needs just by answering a few questions about yourself, your car, and your automobile driving habits. After doing so, you could find what could be low cost auto insurance rates that might work right for you.

Get quotes for low cost auto insurance!

Searching for the lowest auto insurance online is one way people in this current economic outlook consider to potentially save money. So how can you find what could be the potentially lowest car insurance to fit your needs?

One thing to consider for finding what could be low cost auto insurance is to take a defensive driving class. Depending on the auto insurance company you are looking into, you may be able to receive a discount – sometimes as much as 10% — for having taken the defensive driving class.

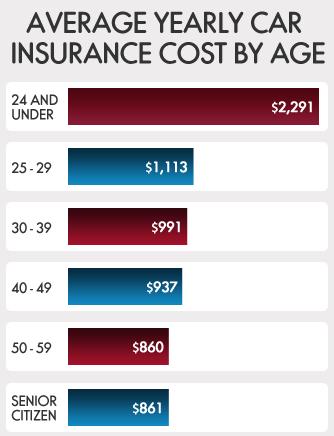

Other things to consider when searching for the potentially lowest car insurance are various discounts you could be eligible for. To give a few examples, some auto insurance companies may offer discounts to people who have particular professions, to students who have a great GPA, to those over 50 who are members of AARP, or to safe drivers – those who have a great, accident-free and ticket-free driving record.

Some of the ways people can find potentially low cost auto insurance include looking for discounts. Here are some of the ways drivers could potentially save money on auto insurance:

• Multivehicle discount – You can be eligible for this when you have auto insurance with more than one car with the same auto insurance company.

• Multiline or bundling discounts– You can be eligible for this when you have both car insurance and renters/homeowners insurance from the same auto insurance company.

• Renewal discount – Some companies offer discounts on rates for long-term customers.

• Anti-theft device discount – You could get a discount on your auto insurance if your car has things like an auto alarm, VIN numbers etched on car windows, or some sort of recovery system for the vehicle.

• Auto safety features discount – Your car has things like airbags, anti-lock brakes, and other safety devices.

• Safe driver discount – If you have a clean driving record – no tickets, accidents, or claims between the past three to five years – you could get a discount. Some companies will give you a discount for this even if you have had one accident or ticket.

When looking for the lowest car insurance, those discounts could save you money. Other things you could consider to potentially get low cost auto insurance is to adjust your deductible to a higher rate. Generally speaking, the higher the deductible, the lower the auto insurance can be. Of course, if you have a higher deductible, you also may need to be in a good financial place, where you can afford to pay, say, a $1000 deductible if your car were to be stolen.

Another ways to potentially save on low cost auto insurance is to dump full coverage if you are driving an old clunker.

Finally, you could potentially find the lowest auto insurance just by going to this quote form, answering a few quick questions, and you could find auto insurance that could work well for you.

Related Article:

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.