Auto Insurance Policy

If you have a car, you will generally need to buy an auto insurance policy in order to legally drive it in your state. But how do you buy a car insurance policy? And what will you need in auto insurance coverage?

Get quotes for an auto insurance policy!

One of the things you may discover right off when it comes to buying an auto insurance policy is that you might have a lot of decisions to make, like how much liability insurance limits you should get, whether you should get comprehensive coverage and/or collision coverage, how much your deductibles should be, whether you should pick up roadside assistance coverage through an auto insurance company, or other car policy questions.

You may also learn that car insurance policy coverage may vary very much in price depending on which company you get coverage with. You may also discover that your rates, even with one company, can vary depending on things like the driving coverage you purchase, the deductibles, and your driving record.

It may seem a little confusing, though, at first. Some say you should think that each auto insurance company has its very own personality and offers specialized items to fit that. For example, if you have a flawless driving record, you generally won’t need to get high risk auto insurance, which some companies specialize in. High risk auto insurance covers drivers who have had DUIs, received a lot of tickets, or maybe even be a young or experience driver. Some car insurance companies may specialize in selling high risk car policy coverage, while other car insurance companies may be looking for just the opposite – safe, low risk drivers who have great driving records – when it comes to selling auto insurance.

You do want to buy the auto insurance policy coverage that is right for you. If you drive a hoopty – a beaten-down old car — you don’t need to look for a car policy for performance car insurance. Of course, you may discover that man auto insurance companies may offer more than one type of auto insurance policy, so don’t automatically rule out a company just because they may specialize in a particular type of auto insurance coverage.

In addition, you may even find that some auto insurance companies use things like credit scores to determine the rates you could be eligible, and will ask for a credit check. They may potentially give auto insurance rates based on the risk – or lack of risk – as to whether a driver will pay his or her bills in a timely fashion, or whether they will skip out on their bills. In that case, the lower the credit score, the higher that customer could pay on an auto insurance policy.

Generally speaking, a car insurance policy is for a six-month period, but some companies offer monthly insurance for cars. It may depend upon your auto insurance company, as well as you.

To find out more information on an auto insurance policy, simply fill out this quote form, and you could find car insurance coverage that could work great for you!

Related Articles

What Are The Average Auto Insurance Policy Rates In The Market?

With Cheap Auto Insurance Online No Reason to go Without Insurance

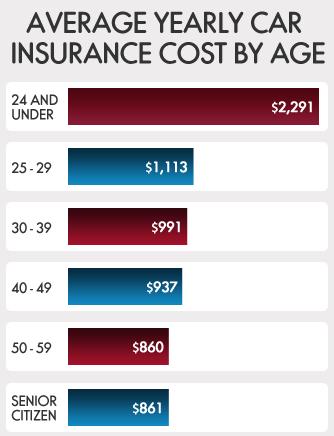

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.