Car Insurance for Women

Is there car insurance for women? Depending on the auto insurance, there may be potentially cheap car insurance for women. There used to be a lot of jokes back in the day about women drivers, but in some cases, women car insurance may have more deals available in the auto insurance marketplace for women than for men. That’s because statistically, women may be less likely to get into a car accident or to get traffic violation tickets than a man. You may be able to find car insurance for women at the click of a mouse, just by answering a few questions.

Get quotes for car insurance for women!

Aside from women generally having fewer accidents and receiving fewer tickets than men, car insurance for women may also be more competitively priced because women receive fewer moving violations citations than men, and fewer women than men may die in automobile accidents. In addition, women might wear seat belts more than men do, and might drive more cautiously.

So why might car insurance for women cost less? It is not because of any sort of discrimination; it is generally because the cost of women drivers might be less expensive than the cost of men drivers. Women may potentially be better drivers; this may mean that womens car insurance could end up costing less than men’s car insurance. This also depends on the driver – a woman who has received a lot of traffic tickets may not be eligible for competitively priced car insurance rates the way a man with a great driving record could potentially be eligible for.

In addition, a woman who is an aggressive driver the way a man could be may also see that car insurance for women may not be any different from a man with aggressive driving behaviors.

Here are some things to consider when it comes to potentially cheap car insurance for women. You first should look into what your individual state’s minimum requirements are for auto insurance. These figures for liability insurance can vary per state. In some cases, you might want to consider getting more than the minimum auto insurance coverage, so that you may be protected in the case of a serious accident.

When it comes to cheap car insurance for women, you also may want to make sure you understand the different types of auto insurance. For example, having collision and comprehensive coverage, which could pay for damages in an accident that is deemed to be your fault, or pay for you to get a new car in case your automobile was stolen. Now, if you have a new automobile, that type of coverage is vital. If you’re driving a hoopty, an ancient auto vehicle, not so much, as the cost of auto insurance could end up costing more than the vehicle is worth.

Also, you might want to look into additional discounts with car insurance for women policies, such as for non-smoking drivers, student discounts, defensive driving discounts, safety discounts, bundling discounts, multiple policyholder discounts, or senior discounts.

To find out more information on womens car insurance, simply answer a few questions in this quote form, and you could be on your way to find auto insurance that could be right for you.

Related Articles

Single Mothers May Get Some of the Cheapest Auto Insurance

Cheap Car Insurance for Women

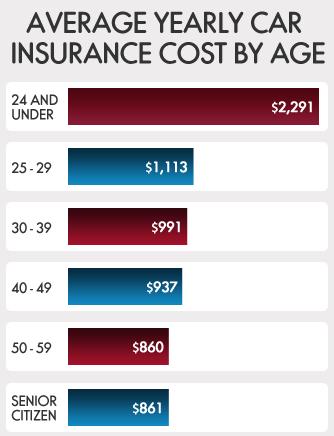

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.