Cheap Student Car Insurance

When it comes to potentially cheap student car insurance, you might be able to find student auto insurance that could be right for you. After all, students are trying to look for ways to save money, and you could find student car insurance at the click of a mouse. Companies online who sell auto insurance could be competing on the web for your business.

Get quotes for cheap student car insurance!

So how can you get started finding potentially cheap student car insurance online? The first step is to do your research – look for information online to understand various insurance terms, such as what liability insurance means, what comprehensive and collision coverage is, and how auto insurance works. It is also important to understand with potentially cheap student car insurance that the better your driving record is, the more likely you will be able to find competitively priced rates.

Another thing to consider with student auto insurance is to look for what is known as “third-party only” or liability coverage. What this gives is a basic coverage for an accident or claim. For example, if you were to get into an accident and cause property damage to another vehicle, having liability insurance could cover the costs of the property damage. The same goes if the accident caused bodily injury. Liability insurance can cover your liability in such cases; thus the name. Generally speaking, if you only get liability coverage, your auto insurance rates could be less expensive than with additional coverage.

In addition, potentially cheap student car insurance can be found be looking for companies who sell auto insurance to young people. When you are shopping for student auto insurance, you might be able to find companies that specialize in the subject, and offer student discounts, or young person’s discounts. You might want to start here by filling out this auto insurance quote form.

Other things to look out for to save money on auto insurance is keeping just the liability coverage, and not picking up the collision and comprehensive coverage. However, if you are a college student going to school in an area where there are a number of auto thefts, you might want to keep the comprehensive coverage that protects against theft. On the other hand, if you have a beat-up old clunker, you might just want to stick with the minimum auto insurance coverage.

If you live close to campus, you might be able to potentially save on cheap student car insurance by not having to drive your car very much. That is something else to think about. Another thing to consider is to get a higher deductible with your auto insurance. Of course, that means that if you did have to file a claim, you will need to have to pay that amount out of pocket, so you might want to keep that sort of money saved in an emergency fund, just in case. Otherwise, you could be in a world or hurt.

You might want to consider finding a car that tends to have a lower auto insurance rate, so you might be able to potentially save on student car insurance. Generally speaking, a safe car could have lower car insurance rates than a sports car.

Finally, keep a great driving record, and drive safely and cautiously, if you want to find cheap student car insurance. Fill out this quote form to learn more about what rates could be available.

Related Articles

What Auto Insurance Discounts To Ask For

Ways To Get Affordable Auto Insurance For Your Teen

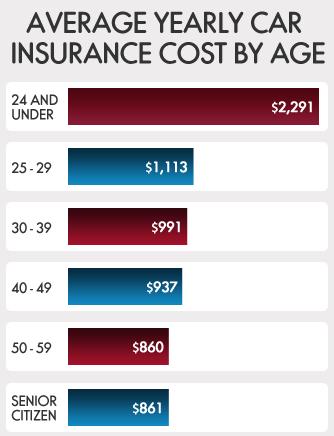

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.