How to Find Cheap Car Insurance

How can you find cheap car insurance? Going to find car insurance may seem like a daunting thing to do, let alone trying to find cheapest car insurance rate. Sometimes, paying for insurance every month seems like a real pain, and even a wasted expense – until you need it, that is. You may not only want to find cheap car insurance, but also find auto insurance coverage that may help take care of you, your automobile, the passengers in your car, and any legal liabilities that could come up from being involved in an auto accident.

Find cheap car insurance quotes!

So where do you start with going to find car insurance? You have a variety of options – calling around, checking websites yourself, visiting auto insurance agencies in person – but who has the time or energy these days to do all that legwork? Also, if you are attempting to find cheapest car insurance, that may seem even more of a challenge with time and energy.

That’s where this quote form can come in. Instead of you running around trying to find cheap car insurance, the quote form may be able to find you what may be affordable auto insurance rates, just at the click of a mouse. The way it works is that you go to the form, answer a few questions about yourself, your automobile, and your location, and you could potentially find cheap car insurance information from one or more auto insurance companies. These days, thanks to the wonder of the internet, you may potentially find cheapest car insurance rates due to auto insurance companies that could be competing with each other for your business.

In addition to finding an auto insurance company that could be right for you, you also may have a good deal of flexibility when it comes to how much coverage you have. For example, you may want to adjust the deductible in order to potentially save money. The deductible is the out-of-pocket bill you have to pay when making a claim before the insurance kicks in. For example, if you have zero deductible coverage with comprehensive and collision coverage, and you had hail damage to your car, you don’t have to worry about scrounging up that deductible before getting your car fixed. On the other hand, you will generally pay more for car insurance when you have a low deductible, or a zero deductible.

When it comes to going to potentially find cheap car insurance, generally speaking, the higher the deductible, the lower the monthly premiums can be. However, if you have a high deductible, like a $1000 deductible, it is important to be able to access that sort of money, like with an emergency fund. Otherwise, if you have to borrow from somebody else to get your car fixed, going to find cheapest car insurance coverage may not have been so cheap after all.

You also might want to see if you are eligible for any discounts, such as multi-car or multi-driver discounts, a discount due to taking defensive driving, a discount due to membership in organizations like AARP and AAA, or discounts based on your car having antitheft coverage, antilock brakes, or passive restraints. Not all companies offer such discounts, though.

So how do you get started to find cheap car insurance? Just fill out this quote form. After doing so, you may get quotes from one or more auto insurance companies. After looking at the rates, you may find car insurance that could be great for you! Get started now!

Related Article:

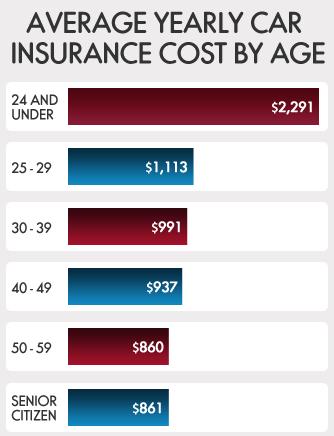

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.