Full Coverage Auto Insurance

Full coverage auto insurance means that, generally speaking, your car may be protected in the case something were to happen to it. Full coverage car insurance means that if your car were stolen and not recovered, or you got into an accident and caused property damage, or if hail were to hit your car, you would be coverage. Granted, full coverage auto insurance may not cover every possibility ever thought of – if your car were to be snatched by space aliens, you might be out of luck as far as expecting auto insurance coverage.

Get quotes for full coverage auto insurance!

How full coverage auto insurance works is that it includes not just the state-mandated liability insurance, which may cover you in the case of property damage or bodily injury, but also collision and comprehensive coverage. Collision coverage may protect your car in the case you were to have an accident that was deemed to be your fault, and whoever you collided with was not responsible for paying for the damage to your automobile. Comprehensive coverage may protect your car in case of things like fire, theft, and hail damage. There are also add-ons to auto insurance policies that include things like replacement auto glass, with no deductible, or towing coverage, or roadside assistance. All these items can add up to full coverage auto insurance.

The coverage can also include additional property damage and bodily injury protection coverage. This way, if you were to collide into someone whose car was worth a lot of money, and you only have the state-mandated minimum for your car insurance, you could find yourself owing a lot of money, without insurance protecting you for what you owe. That’s one of the reasons why finding full coverage car insurance may be important. In addition, things like uninsured motorist coverage may also be a part of full coverage.

You may even discover what may be cheap full coverage auto insurance policies online. The way it works is that you fill out a quote form, answer the questions asked about yourself and your automobile, and you could receive potentially cheap full coverage auto insurance from one or more companies selling car insurance.

Are there any times where full coverage with car insurance may not be right for you? Well, if you are driving around a real clunker, something worth less than a thousand or two, it may not make a whole lot of sense to have full coverage auto insurance, paying for collision or comprehensive coverage, when you could potentially ending spending more on premiums that the car is actually worth. That’s why you need to evaluate whether full coverage car insurance is right for you. It really depends on your individual situation.

So how do you find potentially cheap full coverage auto insurance online? Just start by filling out that quote form. After you may find some auto insurance quotes, you could find full coverage for auto insurance that could work very well for you, your car, and your family.

Related Articles

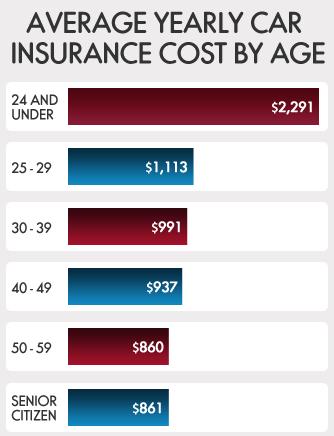

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.