Car Insurance Over 50

One of the good things about getting older is that car insurance over 50 can be more competitively priced than other forms of auto insurance. You may be able to find over 50 car insurance quotes online at the click of a mouse.

Get quotes for car insurance over 50!

Some people may not want to grow older. But finding car insurance over 50 can be one of the advantages of getting older. Some auto insurance companies may offer special car insurance over 50 coverage. In addition, some of them are now aiming advertisements at them. The reason that over 50 car insurance is getting to be more popular is twofold: that older drivers tend to be more careful and responsible, and that drivers over 50 also tend to regularly pay their bills. In addition, drivers over 50 are less likely to file auto insurance claims.

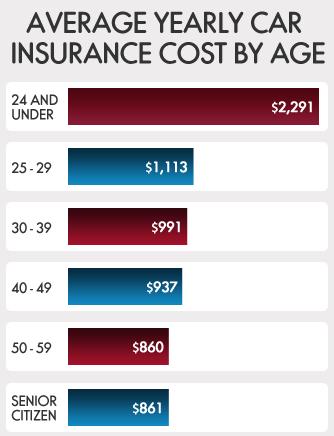

Generally speaking, drivers over 50 have been shown to be careful on keeping good credit ratings, obeying traffic laws, and keeping auto claims cost low as they head towards her retirement years. Because of that, over 50 car insurance quotes may be more competitively priced than the rates for younger drivers.

So, depending on the auto insurance company, there could be over 50 car insurance quotes that could work well for you. In addition to potentially receiving an auto insurance discount for being a more mature driver, there could be some discounts available to the over 50 driver, such as discounts for having no claims, rebates for having a great driving record, and bundling discounts, which apply to drivers who have auto insurance as well as another type of insurance with a particular company. Those discounts and perks may also available to other drivers, not just those eligible for over 50 car insurance.

In addition, there are other discounts that those looking for car insurance over 50 could potentially be eligible for, like from having a hybrid-type car, or getting a safe vehicle discount. There is also a defensive driving discount available if you take the class – it could be a 10% discount, depending upon the auto insurance company.

Over 50 car insurance quotes can also be lower if the driver chooses a higher deductible. Generally speaking, the lower the deductible, the higher the premium, and the higher the deductible, the lower the premium. So if you would like to save a little money on your monthly bill, then go for a higher deductible. Needless to say, you should be prepared to have money available to cover the deductible in the case of a claim, so that a car accident doesn’t send you into a world of hurt.

Another tip for those who are eligible for car insurance over 50 is to drop out of comprehensive or collateral coverage if you have an older, paid-for car. However, this is not a great idea if you have a newer car that is still being paid for.

So how does it work to find car insurance over 50? Just fill out this quote form, answer a few questions, and you could soon find rate quotes for over 50 car insurance that could work well for your life.

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.