How to Find Competitive Rate Quotes from Some of the Top Auto Insurance Companies

If you are looking to discover cheap auto insurance quotes, you may be able to get started in finding rates from what may be considered the top auto insurance companies just by filling out a quote form.

You may be able to find a variety of rate information from some of what could be the best car insurance companies just by completing that quote form. You may also discover that finding what could be great auto insurance coverage could be obtained in an affordable way.

Here are some tips to find what could be cheap auto insurance quotes:

- See if you can qualify for an insurance discount, due to a union membership, a club membership, or due to your age or status, like if you are a student or a senior citizen. You may be surprised of some of the possibilities – ask first, before signing up anywhere, to see if any of the possible discounts they may offer could apply to you.

- If you have taken defensive driving recently, you could get a 10% discount on your auto insurance. The time frame in which you could get that discount could depend on which company you have auto insurance from, and in what state.

- In addition, taking a defensive driving class could, depending on which state you live in, remove a ticket, and/or insurance points, from your driving record, which may also result in lower rates.

- If you have safety devices on your car, such as passive restraint seat belts, anti-lock brakes, anti-theft devices, and airbags, you could also receive a cut on your rates, depending on your car, and the insurance company.

- The type of car you drive, and how old it is, may affect your insurance rates. If you have an older car – not a classic ’57 Chevy, or something worth a lot of money, but, say, a 10-year-old car, you may have lower insurance costs than if you have a spanking-new car. That’s because repair costs and replacement costs would be newer with a newer car than an older one. For example, if you had a $25,000 car, and it was stolen and never recovered, it would cost your insurance company a heck of a lot more to replace that than if you were driving a $2,000 beater.

- Another way the kind of car could affect your insurance rates is if you buy a high-end sports car like a Lamborghini. Suffice it to say that car insurance quotes you may receive for the automobile, which can cost hundreds of thousands of dollars, will be a wee bit higher than if you had a Volkswagen.

- Find out if you qualify for a bundled discount if you already have an insurance policy with that company.

So how does it work to find auto insurance quotes from what could be the top auto insurance companies? Basically, you fill out a quote form answer some questions about yourself, your car, and where you live, and you could find information from one or more of the top auto insurance companies that potentially could be right for you. Why not get started today!

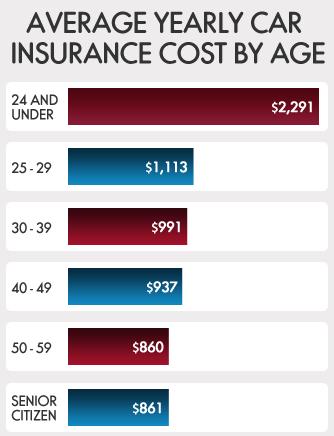

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.