Inexpensive Auto Insurance

Finding inexpensive car insurance is something many drivers might be looking into these days. Looking for inexpensive auto insurance quotes may help you find competitively priced auto insurance, which could be a boon in this economy. At the click of the mouse, you could find quotes online for inexpensive auto insurance just by answering a few questions about yourself, your car, and your driving history.

Get quotes for inexpensive auto insurance!

So how do you find inexpensive auto insurance? Well, checking out that quote form may be a good start. In some cases, you could find inexpensive car insurance with your current auto insurance company, simply by asking around at your current auto insurance company. For example, some companies may offer new car discounts for auto insurance for the first year or two after the car’s purchase date.

Some companies may give you a long-term customer discount, or a renewal discount, if you stay with them a long time.

Besides that, inexpensive auto insurance can also be found if you have a car with lots of safety features, such as numerous airbags, anti-lock brakes, and various stability mechanisms in the automobile. In addition, inexpensive auto insurance can also be based on security mechanisms with your car, such as an anti-theft system, an alarm, or other safety features to prevent car theft.

Taking defensive driving may also save you as much as 10% on your auto insurance coverage. depending on which company you have for car insurance. Generally speaking, that discount could last for three years before you need to take the defensive driving class again.

Of course, you can find inexpensive auto insurance by streamlining or cutting your current policy as well. For example, if you are driving an ancient clunker, it might not make much sense to have collision and/or comprehensive auto insurance coverage that could cost as much per year as the automobile is actually worth. So in that case, you might want to drop comprehensive and collision coverage.

Another way to find inexpensive auto insurance is to raise your deductible. Generally speaking, the higher your deductible, the lower your monthly premium. If you have an auto insurance policy with a $0 or a $250 premium, you may have a significantly higher auto insurance bill than if you have a $500 deductible or a $1000 deductible. However, please keep in mind that if you decided to raise your deducible, you could have significant out-of-pocket expenses when filing an auto insurance claim, so it may be worth it to have an emergency fund with savings that could help you pay for that deductible cost.

Inexpensive auto insurance quotes can also be had if you try to find things like multi-vehicle discounts, or bundling discounts – having auto and homeowners insurance by the same company.

In addition, some companies may find you inexpensive car insurance if you sign up with them as a new customer. You may be surprised at the big price differential that could exist between different companies. So it might be worth your time to shop around.

So how do you do that? It’s easy. Simply get online to find inexpensive auto insurance quotes. Start here at this quote form, and you could find auto insurance information which could work well for you.

Related Article

Hit the Road With Auto Insurance San Diego

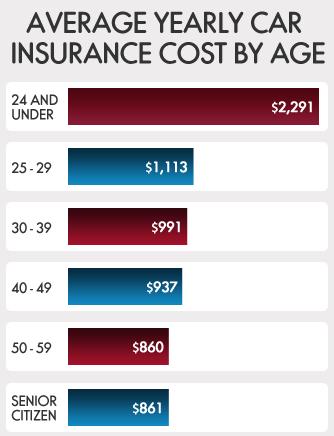

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.