Best Car Insurance

Finding what could be the best car insurance for what you need is easier than you think. What can be the best auto insurance for your needs depends on a variety of factors. You may also be able to find some of the best auto insurance companies at the click of a mouse:

Get quotes for some of the best car insurance!

For example, if you have purchased a brand-new automobile, looking for the best car insurance for your car will most likely include collision and comprehensive coverage. That way, you may be protected in case of things like fire, theft, or a car accident. In addition, if you are still paying off your car, or you have a lease, the company financing your car may require you to have that comprehensive and collision coverage anyway. After all, if your car were to be stolen, and you still owed $30,000 on it, you could be up the creek without a paddle if you did not have collision coverage.

On the other hand, if you are driving a worn-out clunker on its last legs, the best car insurance may include not having collision or comprehensive coverage, because the cost of paying auto insurance over a year could even exceed the cost of the car, depending how old your automobile is. So in that case, the best car insurance could mean figuring out your individual situation.

As for liability insurance, you may want to have more than the state-mandated minimum. That’s because if you were to get into an accident and cause property damage or bodily injury damage, and it totals up to be more than you are covered for, you could end up with a big bill you could be responsible for – or even worse, facing a lawsuit. So the best car insurance could be one where you could be protected against such things by having enough coverage.

Deductibles also play a part in deciding what could be the best car insurance coverage. If you have an emergency fund on hand to pay for a deductible, then it doesn’t make a whole lot of sense to have a $0 deductible, when it generally will cost you more money each month on your auto insurance premium. On the other hand, if having to pay a $500 or a $1000 deductible would become very hard for you financially, you might want to keep a lower deductible, but pay a bit more each month for your auto insurance. The best auto insurance for you here would depend on your individual situation.

As for the best auto insurance out there, you may be able to find some of the best auto insurance companies at the click of the mouse. So instead of having to search through the websites of a variety of auto insurance agencies, or personally talk to a slew of insurance agents, you could find a quote comparison on car insurance rates just by filling out the quote form, and you could be on your way to finding great auto insurance coverage quotes from some of the best auto insurance companies out there.

Related Articles

Tracking Down the Best Auto Insurance Rate

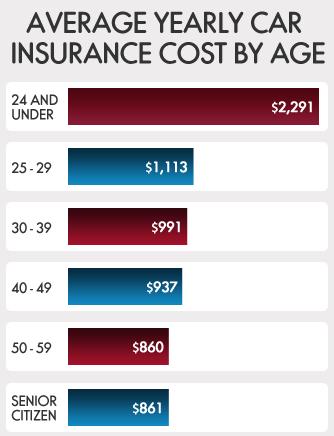

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.