High Risk Auto Insurance

Looking for high risk auto insurance? Don’t think that you are doomed to paying the worst auto insurance rates out there. Even with high risk car insurance, you might be able to find car insurance coverage that could be right for you. You may also be able to find potentially cheap high risk auto insurance coverage.

Get quotes for high risk auto insurance!

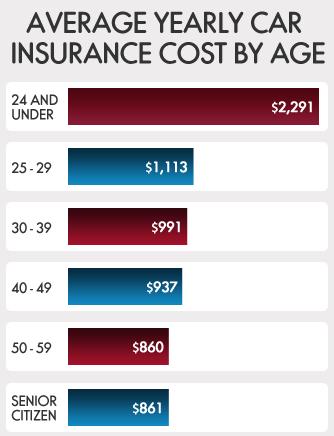

So what is high risk auto insurance? There are many drivers who could fall into this category. For example, some insurance companies may classify teenage drivers as high risk auto insurance, and some may consider all drivers under age 25 as high risk, depending on the company. Newly licensed drivers who are not teenagers may also be categorized as needing high risk car insurance.

In addition, high risk auto insurance may also be the classification not just for drivers who have been busted for driving while intoxicated, or driving under the influence, but also for those drivers who have received multiple tickets and have been in multiple automobile accidents. Some companies may even consider those with bad credit as needing high risk auto insurance, as well as drivers who have had prior accident claims.

However, the thing is about high risk auto insurance is that what some companies consider as high risk customers might not be considered high risk by other companies, which is why it may pay to comparison shop when it comes to potentially cheap high risk auto insurance. One company’s high risk insurance is another company’s normal risk insurance; for example, companies that do not bother with credit checks would not consider somebody with a not-so-great credit report as a high risk for auto insurance. So that is something to keep in mind. The same goes with young drivers – not all companies rate drivers under 25 as being classified as high risk; instead, some of them look at the individual situation. So that’s another case where you might want to check around.

There are also some companies who cater to those who are classified as high risk when it comes to auto insurance. They make it their business to offer competitive rates, and to offer potentially cheap high risk auto insurance when they can. So for those who are worried that they won’t be able to find auto insurance to fit their needs, even if they are classified as being a high risk when it comes to car insurance, need not fret. There may be companies competing for their business online, even if they are looking for high risk car insurance.

So how does it work? Basically, you go to the quote form, answer the questions about yourself, your driving record, and your automobile. After doing so, you could receive information from car insurance companies offering you rate quotes, even if you are classified as a high risk driver. You may also be able to find a competitively priced high risk car insurance policy that could work well for you. So get started today at finding the policy that could work well for you!

Related Article:

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.