Property Damage Liability: How to Help Protect Your Car and Guard Against High Costs

Car accidents may be very expensive, from the potential property damage liability and/or bodily injury liability involved, to any possible medical bills, to the cost of repairing your car. If you are found to be wholly or partially responsible for the accident, and you don’t have the correct amount of collision coverage or liability coverage, you could find yourself in a world of financial hurt. What if you were to get sued? How would you pay for it? That’s where having car insurance policies that can help cover those items can come in.

Get quotes for some of the top rated car insurance!

Auto insurance policies offer various types of coverage that are meant to provide a way of helping to protect not just you, your car’s passengers, and your automobile. For example, collision coverage may help pay for your car to get repaired in the case of a car accident that you are help partially or fully responsible for (if the other driver is at fault and has insurance, you generally do not have to pay to get your car fixed.) Comprehensive coverage may protect against things like theft and fire, as well as things like getting stuck in a hailstorm.

In addition, there are also some car insurance policies that may help protect your finances in the event of an auto accident – specifically, they can provide coverage that offer personal injury protection, as well as take care of expenses like other people or property getting hurt or damaged. If you have an accident with a Lamborghini or even a Mercedes and you were considered to be at fault, imagine the bills involved.

Or if you were to get sued for your part in a car accident, you may end up having to deplete your savings, and borrow from the value of your home, just to pay for the costs. That is why having sufficient property damage liability insurance and body liability coverage can be so critical. Liability insurance may be a requirement to drive a car; however, there is only a certain minimum amount required by your state, and if you were to cause bodily damage, or property damage, to someone, the minimum may not be enough to protect yourself. In addition, if you do have a lot of personal assets, but do not have sufficient liability coverage, you could find yourself at the end of a big lawsuit going after your assets.

So how can you balance having the bodily liability and property damage liability coverage that may be right for you, and balance the cost of the coverage as well? Here are some tips:

- Decide what it is that you may want to cover and not cover with your car insurance policy: You may want to have extensive liability coverage, but if you are driving a beater that has seen better days – or better decades – you may not want to fuss with collision coverage. You also might want to skip the rental reimbursement coverage if you do not drive that much, and public transportation is readily available in your area.

- Choose the right deductible for you: Generally speaking, the higher the deductible, the lower your monthly auto insurance premiums could be. If you have a strong emergency fund – with more than a thousand or two saved – you could have a higher deductible, and not have to worry about digging up money to pay the deductible.

- Take a look at which factors could affect your auto insurance rates: The amount you drive can be a factor, as well as your driving record, and where you live. If you have a great driving record, see if you could qualify for a safe driving discount.

If you would like help in getting started in finding auto insurance information, by letting car insurance companies compete for your business, just complete this quote form today!

Related Articles:

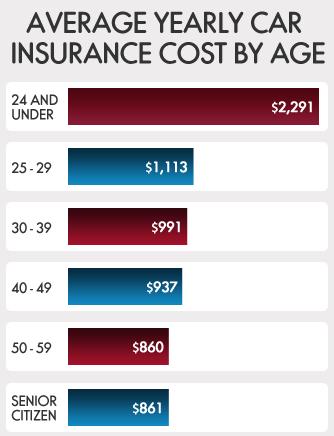

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.