State Auto Insurance Companies

State auto insurance companies may not offer the same rates and coverage for each state, so auto insurance rates by state may vary, due to varying laws and requirements per state, as well as economic conditions. For example, you may pay more for state auto insurance in Alaska than in Nebraska, due to the higher cost of living in Alaska. You might want to get flood protection coverage if you live near the water. If you live in Arizona, not so much.

Get auto quotes for your state!

So how do you figure out state auto insurance, and what different laws may mean in different states as far as auto insurance? The good news is that you don’t need to spend time doing that — state auto insurance companies will do that for you. You don’t have to become some expert as to how auto insurance rates by state may vary, due to differing laws in the 50 states. Instead, you may be able to find auto insurance rates by state simply by going to a quote form and answering a few quick questions.

After filling out the form, and answering a few questions about yourself and your vehicle, you could potentially find a variety of state auto insurance rates. It’s a whole new world out there — state auto insurance companies may be competing for your business online. Instead of you needing to make a lot of phone calls, or visit insurance agents in person, or check out a whole lot car insurance websites on your own, the quote form will do all the legwork for you, as a variety of state auto insurance companies may potentially give you rate quotes in an effort to compete for your business.

Auto insurance is a state requirement, but that does not mean that you are required to take on all the coverage that an auto insurance company offers. So if you already have emergency roadside assistance and towing protection from another company, you do not have to buy it through your auto insurance company.

You can also adjust the deductible you pay – you do have flexibility on that. For example, if you have a clunker that is on its last legs, it might not make a whole lot of sense for you to pay for collision or comprehensive coverage with a $0 deductible. If you have an emergency fund where you can pay for the deductible cost out of pocket, it could make better financial sense to either have the comprehensive or collision coverage with a high deductible, or you could possibly drop that additional coverage entirely.

With the coverage regarding state auto insurance companies, perhaps you might want to get higher liability insurance than the state requires you to have, so that you could be more fully protected in case of property damage or bodily injury claims. This way, if you were found to be liable in the case of an accident, you may not have to take from your savings, or worse, to borrow from the value from your home, in order to pay for the costs of the damage.

So, if you would like to get started finding information from state auto insurance companies, check out this quote form and get cracking now on finding what could be a variety of competitively-priced auto insurance rates that could work very well for you!

Related Article:

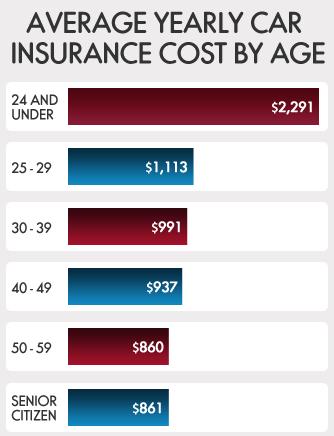

Averages based on quotes from four insurance providers. Information provided for the driver and vehicle consistent for all quotes to increase accuracy.